For instance, if you presently lug an SR-22 as well as relocate to a state that that does not require an SR-22, you still need to correctly meet the needs of the SR-22 in the state it was originally provided in. Additionally, your new insurance coverage have to have responsibility limits which satisfy the minimums required by legislation in your former state.

How do I obtain SR-22? You need to call your insurance coverage supplier to acquire an SR-22. If your insurance coverage service provider does not offer SR-22 or is going to terminate your coverage as a result of this requirement, you can get in touch with Sarah or Dane Hamilton at HL Insurance Coverage Team at (720) 343-7459, as they use SR-22 and also all of your other insurance coverage requires at competitive prices.

You must call your insurance policy company as well as a number of other insurance provider to acquire a quote - insurance companies. SR-22 is fairly affordable; nonetheless, SR-22 is a red flag to your insurance policy service provider that you have issues with your driving background as well as are currently a high threat loss. Asking for and also obtaining SR-22 allows your insurer know something is happening with your driving background and also urges the insurance coverage company to check out further right into why you are being needed to have an SR-22.

This information is what triggers the insurance provider to significantly elevate your prices as they currently categorize you as high danger. motor vehicle safety.

In Wisconsin, You Have to Have an SR-22 for a Minimum of 3 Years There is a whole lot of confusion surrounding both SR-22s and also OWI offenses as a whole. Find out more An SR-22 is a kind that your insurance coverage firm submits with the DMV to license that you are insured after being classified as a risky motorist. Will Insurance Rates Keep High? Your insurance policy prices are most likely to remain high for concerning 5 years, depending on your service provider.

Get in touch with your insurance supplier to locate out your state's current needs and also make certain you have appropriate protection. How long do you need an SR-22? Many states need vehicle drivers to have an SR-22to verify they have insurancefor regarding 3 years.

Not known Details About Bmv: Licenses, Permits, & Ids: Proof Of Financial Responsibility

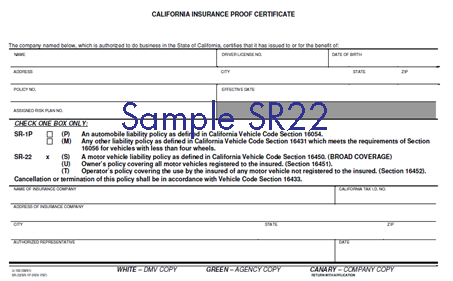

An SR-22 is not a real "type" of insurance coverage, however a form submitted with your state. This kind serves as proof your automobile insurance policy satisfies the minimum obligation coverage needed by state regulation.

Do I need an SR-22/ FR-44?: DUI sentences Reckless driving Accidents created by uninsured drivers If you require an SR-22/ FR-44, the courts or your state Motor Vehicle Department will inform you.

Is there a cost connected with an SR-22/ FR-44? This is an one-time cost you must pay when we file the SR-22/ FR-44.

A declaring fee is billed for every private SR-22/ FR-44 we submit. If your spouse is on your plan as well as both of you require an SR-22/ FR-44, then the declaring charge will certainly be charged two times. Please note: The fee is not included in the price quote since the declaring charge can vary. department of motor vehicles.

insurance sr22 sr22 insurance division of motor vehicles insurance companies

insurance sr22 sr22 insurance division of motor vehicles insurance companies

How much time is the SR-22/ FR-44 valid? Your SR-22/ FR-44 should be legitimate as long as your insurance plan is energetic. If your insurance coverage policy is canceled while you're still required to bring an SR-22/ FR-44, we are needed to inform the correct state authorities. If you do not maintain constant coverage you can lose your driving opportunities.

Just how much your rates boost depend upon the severity of the driving infraction that caused you to file an SR-22. Learn even more concerning SR-22 insurance coverage certificates in Texas, consisting of: What is an Economic Obligation Insurance Coverage Certification (SR-22)? An SR-22 kind is compulsory for chauffeurs with a put on hold license due to high-risk violations.

The Buzz on Sr22 Insurance In Minnesota Explained - Policy Advice

The kind should be filed straight with the state of Texas by your insurance carrier. These are some of the factors your certificate might have been revoked and you have to file an SR-22: Driving while intoxicated (DWI) Racking up a lot of factors on your driving record within a specific amount of time Multiple convictions for driving without valid insurance policy Your SR-22 plan should meet the state's insurance policy needs. liability insurance.

If your plan lapses or you terminate it before those 2 years are up, your insurer will notify the state. If you do not send another SR-22, you might take the chance of one more license and also registration suspension - bureau of motor vehicles. That gap in insurance coverage implies you'll need to pay reinstatement charges as well as purchase a new insurance plan.

After you submit the SR-22 with the state, you must pay a $100 certificate reinstatement fee. Just how a lot does SR-22 insurance price in Texas?, you are required to pay a $100 permit reinstatement fee after you send your SR-22 to the Texas DPS, along with any kind of other outstanding charges owed.

Besides those fees, an SR-22 plan does not directly have added costs. However, as a result of the significant infraction that needed you to submit the form, your insurance policy costs will likely leap. You may be taken into consideration a "risky" motorist with an SR-22 on document, which suggests insurance carriers may charge you a lot more.

Non-owner automobile insurance policy fulfills the needs to have your certificate renewed as well as provides protection whenever you drive another person's automobile. LLC has striven to guarantee that the information on this website is right, yet we can not ensure that it is free of inaccuracies, mistakes, or omissions. All material as well as solutions supplied on or with this site are offered "as is" and also "as available" for usage - auto insurance.

com LLC makes no depictions or service warranties of any kind, express or suggested, as to the procedure of this website or to the information, material, materials, or products consisted of on this website - insurance coverage. You specifically agree that your use of this website goes to your single threat.

Sr22 Insurance In Salt Lake City Utah Fundamentals Explained

If you just recently obtained a DUI, after that you may be required to lug SR22 insurance policy for the Drunk driving. What Is SR22 Insurance Policy DUI?

An SR22 is sometimes utilized to renew a driver's license following a suspension that comes with a drunk driving charge. The form itself verifies that you have the minimum insurance protection called for by your state regulation. SR22 might additionally be described as: Certificate of Financial Responsibility, SR-22 Bond, SR-22 Form, SR22SR22 is not a kind of insurance coverage (sr-22).

sr22 insurance driver's license liability insurance credit score no-fault insurance

sr22 insurance driver's license liability insurance credit score no-fault insurance

In some states, you might likewise be able to get it from your insurance policy company. sr22. While an SR22 is generally needed when a chauffeur obtains a DUI charge, it might additionally comply with various other sorts of charges. A few of these include driving without insurance, a high occurrence of accidents or relocating violations, and also a difficulty license.

According to Progressive, an SR22 form is just one factor to consider when calculating your rates. Your insurer will additionally factor in your age, place, driving document, as well as credit rating. Consequently, your rates complying with an SR22 type will differ from supplier to company. In addition to filing an SR22, some states might likewise call for vehicle drivers convicted of a DUI to additionally complete a chauffeur safety and security training course to renew their permit.

On average, a lot of states require motorists with a DUI to file an SR22 for three years after their fees. Depending on the number of Drunk drivings on your record, your state could require you to file an SR22 for life.

dui underinsured sr22 insurance insurance companies auto insurance

dui underinsured sr22 insurance insurance companies auto insurance

driver's license division of motor vehicles sr22 department of motor vehicles insurance group

driver's license division of motor vehicles sr22 department of motor vehicles insurance group

You might also receive a letter from the state. Rather, you will certainly have to demand that your insurance policy firm remove the type. coverage.

Sr-22 Information : Oregon Driver & Motor Vehicle Services for Beginners

SR22 form. Relocating to a Various State with an SR22 Type, Because state legislations differ when it comes to a DUI as well as SR22 kinds, you will need to investigate your brand-new state's needs if you move.

In these states, they might have their very own variation of the SR22 types or they might merely need that you give evidence of insurance. Just how to Submit an SR22 FormFiling an SR22 kind is simple. When you send it to your insurer, they will add the insurance endorsement to your plan and also alert the state that you have enough insurance coverage.

Right here are a few insurance coverage companies that do supply SR22 plans: Mercury, GEICOUnited, CSAAFarmers, Allstate, Progressive, State Farm, It is always an excellent concept to be straightforward when asking for quotes from insurance policy service providers. dui. An SR22 is likely to have some result on your prices meaning you will certainly get the most precise quotes when you review it upfront.

Shopping about is one of the finest ways to obtain the most affordable rates, even with an SR22. Learn just how much each supplier will cost you, contrasting the degree of insurance coverage supplied with the rate. Additionally, figure out if you are eligible for any kind of discounts which can reduce your insurance prices much more - sr22.

Has your certificate been put on hold? If so, you might have been informed that you require to submit an SR-22 certification prior to you can get your certificate renewed. Numerous states need that risky vehicle drivers, such as those who have a DRUNK DRIVING, put on hold permit or have devoted numerous relocating violations in a brief duration, offer an SR-22 kind before they can drive once again. ignition interlock.

SR-22 insurance coverage in Texas is a certificate that shows you have actually gotten the required insurance protection to go back to the road. motor vehicle safety. This form, completed by your insurance policy business, serves as a certificate of duty, mentioning that you can get and bring your own liability protection. The kind will consist of: Lorry information, such as VIN.

The Facts About Financial Responsibility (Sr-22) - Dol.wa.gov Uncovered

Your insurance provider must notify the Texas Department of Motor Automobiles (DMV) if your insurance gaps (sr22). You have to keep SR-22 protection for the specified length of time or you risk going against Texas legislation. An SR-22 is not a kind of insurance coverage; it's a certificate speaking with your fiscal responsibility that is filed with the state.

You can file an SR-22 by asking for one from your insurance coverage carrier and sending it to the Texas DMV. If you do not owe any type of fees, or your reinstatement costs have actually been paid on the internet, the SR-22 type can be submitted by mail, fax, or email.

When you collaborate with Select Insurance Team, we might be able to assist you find rates as reduced as $15 each month. insure. These expenses are in addition to the rates you will certainly pay for your insurance policy.